After spending $87,000 on their first van conversion and nearly going broke within six months on the road, Sarah and Mike learned the hard way that van life mistakes can be financially devastating.

What started as a dream to live freely turned into a financial nightmare that almost sent them back to their old jobs.

Many aspiring van lifers make the same error. They see Instagram photos of perfect sunsets and think van life is cheap. They’re wrong. Hidden costs pile up fast. Small mistakes turn into big bills. And before they know it, their savings are gone.

Sarah and Mike made every expensive mistake imaginable. They bought the wrong van. They overbuilt their conversion. They chose poor campsite locations and ate at restaurants too often. Each mistake cost them money they didn’t have.

But they learned from every error. Now they live comfortably on $2,000 per month and help others avoid the same costly mistakes associated with van life.

This article highlights the 15 most expensive mistakes Sarah and Mike made in their van life. You’ll learn exactly how much each mistake costs them. More importantly, you’ll discover simple ways to avoid these expensive van life errors and protect your van life budget before it’s too late.

15 Van Life Mistakes That Will Bankrupt You (We Made Them All)

Pre-Purchase Mistakes That Cost Thousands

Sarah and Mike thought they had found the perfect van. It had clean paint and a nice interior. The seller seemed honest. They handed over $45,000 without getting it inspected. It was a big mistake.

Within two weeks, the transmission started slipping. The engine had oil leaks. The electrical system was a mess of cut wires and tape. Their “perfect” van needed $12,000 in immediate repairs just to be safe on the road.

This happens more often than you’d think. About 73% of first-time van buyers face unexpected repair costs within their first three months. The reason is that they make these costly van purchase mistakes:

They Buy with Their Eyes, Not Their Brain

A van that looks good might hide serious problems. That fresh paint could cover rust. Clean floors might hide water damage. Always get a pre-purchase inspection from a qualified mechanic. It costs $200-400 but can save you thousands.

They Don’t Budget for Immediate Fixes

Even good vans need work. Tires, brakes, fluids, and basic maintenance add up fast. Budget at least $3,000-$ 5,000 for immediate needs after purchasing a used van.

They Pick Pretty Over Practical

Instagram-worthy vans often have weak engines or bad transmissions. A van with surface rust but a strong drivetrain will serve you better than a showroom beauty with mechanical issues.

They Rush the Decision

Van shopping takes time. Compare at least 5-10 options. Check maintenance records. Talk to previous owners. Sarah and Mike bought the first van they saw because they were excited. That excitement cost them $12,000.

They Ignore Red Flags in Maintenance Records

Missing oil change records mean neglect. Frequent repairs suggest bigger problems. The absence of records is a warning sign. Good maintenance records are worth paying extra for.

The Smart Financial Strategy

The smart move is to set aside 20-30% of your van budget for unexpected repairs and upgrades. A $30,000 van might need $6,000-9,000 in additional work. Plan for it, and you won’t get surprised by van life budget mistakes.

Expensive Van Conversion Mistakes

Mike wanted the best of everything: top-shelf solar panels, premium lithium batteries, and professional-grade inverters. He spent $8,000 on electrical components that would power a small house.

Their actual power needs were running a laptop, charging phones, and a small fridge. A $2,000 AGM battery system would have done the job perfectly. That’s a $6,000 mistake right there.

This is the most expensive van conversion mistake people make. They overbuild everything because it sounds better on paper. But van life isn’t about having the best gear. It’s about having gear that works for your actual needs.

They Over-Engineer the Electrical System

Most people need 200-400 watts of solar and 200-400 amp hours of battery storage. But they buy 800-watt systems with 600 amp hours of lithium batteries. The extra capacity sits unused while their bank account sits empty.

They Use Premium Materials for Everything

Bamboo flooring looks great on Instagram. But vinyl plank flooring works just as well and costs 70% less. Same with countertops, walls, and storage solutions. Function matters more than fancy materials.

They Hire Professionals for Simple Jobs

Professional installation markups run 200-300% over DIY costs. A $500 DIY job becomes a $1,500 professional job. Basic electrical work, plumbing, and carpentry are easier than most people think. YouTube can teach you most skills you need.

They Build for Photos, Not Life

Instagram-worthy builds cost 40% more than functional builds. That floating bed looks cool, but it wastes storage space. The marble countertop is pretty but heavy and expensive. Build for your daily life, not your social media followers.

They Don’t Plan the Layout First

Sarah and Mike built cabinets, then realized they couldn’t reach the back of them. They installed the fridge, then found out the door hit the cabinet. Poor planning led to rebuilding whole sections. Measure twice, build once.

The Reality Check Approach

Start with your actual needs. How much power do you use? What storage do you need? How do you live day-to-day? Build for that reality, not an imagined perfect life.

Their second van conversion cost $15,000 and works better than their first $35,000 build. Sometimes, less really is more.

Road Life Mistakes That Drain Your Bank Account

Sarah loved nice campgrounds. Hot showers. Clean bathrooms. Wi-fi that worked. She booked KOA and state park sites for $45-60 per night. After three months, they’d spent $4,100 on camping fees alone.

Meanwhile, they met couples who rarely paid for camping. They used apps to find free spots on public land. They showered at gyms and truck stops. Their camping costs were almost zero.

This difference adds up fast. $50 per night is $18,250 per year. Free camping saves you enough money to buy a nice used car.

They Pay for Camping Instead of Boondocking

Free camping exists everywhere if you know where to look. National forests, BLM land, and Walmart parking lots don’t charge fees. Apps like Campendium and FreeRoam show thousands of free spots. You might give up some amenities, but you keep your money.

They Eat Out Constantly

Restaurant meals cost $25-40 per person per day. Cooking in your van costs $8-12 per person per day. Over a year, that’s $6,200-10,200 in extra food costs. Learn to cook simple meals in small spaces. Your wallet will thank you.

They Have No Emergency Fund

Van breakdowns happen. Sarah and Mike’s transmission died in Utah. The repair cost $3,500. They had to put it on credit cards because they’d spent their emergency money on campgrounds and restaurants. Set aside $5,000 minimum for van emergencies.

They Skip Preventive Maintenance

Oil changes cost $50. New engines cost $8,000. Regular maintenance prevents expensive failures. Follow your van’s service schedule even if it feels like a waste of money. It’s saving you money.

They Choose Expensive Routes and Destinations

Alaska is beautiful but expensive. Gas, food, and camping all cost more in remote areas. Popular tourist spots charge premium prices. Plan your route around affordable areas, especially when you’re starting.

The Financial Reality

The math is simple. Free camping, home cooking, and smart routes can cut your monthly expenses by $1,000-1,500. That’s $12,000-18,000 per year you keep in your pocket instead of spending on living in a van expenses.

Technology and Communication Mistakes

Mike was convinced they needed perfect internet everywhere. He bought a $2,800 Starlink setup with all the accessories. The sales rep promised it would work anywhere. Reality hit hard in the mountains of Colorado. Trees blocked the signal. The system worked maybe 60% of the time. Dense forests made it completely useless.

They could have bought a $200 cellular booster and multiple data plans for a fraction of the cost. The result would have been better coverage in more places.

They Over-Invest in Internet Gear That Doesn’t Deliver

Starlink works great in open areas but fails in forests and canyons. Expensive boosters help weak signals, but can’t create signals that don’t exist. Research coverage maps before buying expensive equipment.

They Buy Every New Gadget Without Testing

Van life tech companies love to sell solutions to problems you don’t have. That $500 monitoring system might tell you your battery voltage, but a $15 multimeter does the same job. Buy based on actual needs, not marketing promises.

They Ignore Data Plan Limits and Costs

Unlimited plans aren’t unlimited. Most have deprioritization after 50GB or hotspot limits after 15GB. Going over these limits triggers expensive overage fees. Some van lifers pay $200+ per month in extra data charges because they didn’t read the fine print.

They Pick the Wrong Carriers for Rural Areas

Verizon works well in cities but struggles in remote areas. AT&T has better rural coverage but costs more. T-Mobile is cheap but has the most coverage gaps. Research coverage maps for the areas you’ll visit most. Consider having two different carriers for backup.

The Smart Connectivity Strategy

The smart approach is to start simple. Get a basic cellular booster ($200-400) and two different data plans from different carriers ($100-150 total). Test this setup for six months before buying expensive satellite internet. You might find it works better than you expected.

Most van lifers need reliable email and basic web browsing, not streaming 4K videos. Match your technology budget to your actual usage, not your imagined needs.

Insurance and Legal Mistakes

Sarah thought their regular car insurance would cover their van conversion. After all, it was still technically a van. But she was wrong.

When a tree branch damaged their $35,000 conversion, insurance only paid out $15,000. They’d added $35,000 worth of improvements but never updated their coverage. The insurance company considered it a basic cargo van worth $15,000.

That $20,000 difference came out of their pocket.

They Don’t Get Proper Insurance for Conversions

Standard auto insurance covers the base vehicle, not your additions. Solar panels, electrical systems, and custom cabinets aren’t covered unless you specifically add them. National General and Progressive offer RV policies for converted vans that cover your improvements.

They Ignore Domicile Requirements

You need a legal address for taxes, voting, and mail. Some states are van-life friendly with low taxes and easy requirements. Others are expensive with complex rules. South Dakota, Texas, and Florida are popular domicile states for van lifers. Research the costs and requirements before choosing.

They Skip Proper Registration

Some states require RV registration for converted vans. Others allow regular vehicle registration. Get this wrong and you’ll face fines and legal problems. Check requirements in your domicile state and any states you’ll visit regularly.

They Assume They Understand Mail Forwarding

Mail forwarding services cost $100-300 per year plus forwarding fees. Some services are reliable. Others lose your mail or charge hidden fees. Research services carefully and read reviews from actual van lifers.

The Legal Protection Strategy

The legal side of van life isn’t exciting, but getting it wrong is expensive. Budget $500-1,000 per year for proper insurance, domicile fees, and mail services. It’s cheaper than dealing with legal problems later.

Talk to insurance agents who understand van conversions. Join van life forums to get recommendations for domicile and mail services. A little research upfront saves big headaches down the road.

Health and Safety Mistakes

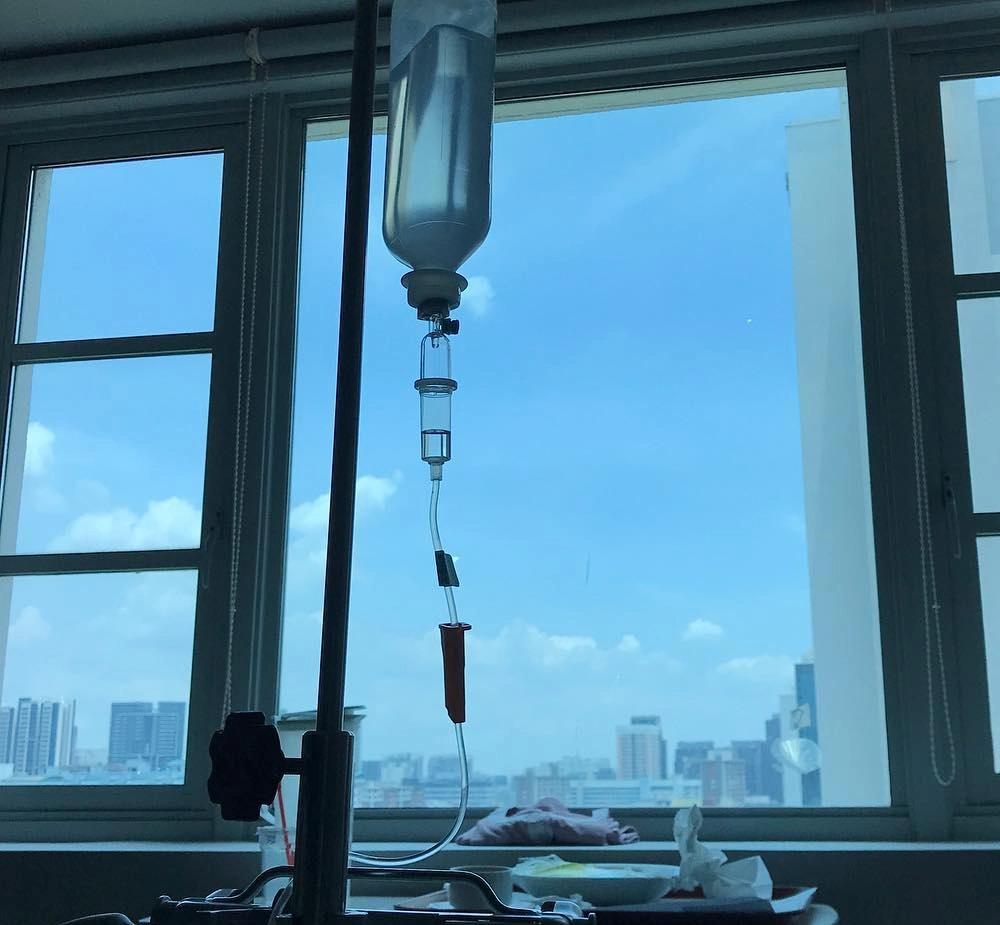

Mike thought he was young and healthy. Why pay for expensive health insurance when he felt fine?

Then he got food poisoning in the middle of nowhere in Nevada. The nearest hospital was 100 miles away. The emergency room bill came to $8,500 for IV fluids and basic treatment. That’s more than most people spend on health insurance in two years.

They Skip Health Insurance or Buy Inadequate Coverage

Van life doesn’t make you immune to accidents or illness. If anything, you’re more likely to need medical care while doing outdoor activities far from home. Research health insurance plans that work across state lines. Some plans have limited networks that don’t cover rural hospitals.

They Don’t Carry Proper Safety Equipment

A $200 satellite communicator can summon help when cell phones don’t work. A $100 first aid kit can handle minor injuries. Basic safety gear costs a few hundred dollars. Emergency rescue services can cost thousands.

They Ignore Mental Health Costs

Van life can be isolating and stressful. Money problems make it worse. Some people need counseling or therapy to cope. Budget for mental health services just like physical health. Many therapists now offer video sessions that work from anywhere.

They Create Physical Problems with Poor Ergonomics

Cramped sleeping spaces cause back problems. Awkward driving positions create neck pain. Poor lighting strains the eyes. Physical therapy costs add up fast. Invest in good mattresses, proper seating, and adequate lighting from the start.

The Health-First Strategy

The smart approach is to keep comprehensive health insurance even if it costs more. Carry basic safety equipment and know how to use it. Budget $100-200 per month for health-related expenses, including insurance, medications, and emergency supplies.

Your health is your most important asset on the road. Don’t gamble with it to save a few dollars.

Relationship and Social Life Mistakes

Sarah wanted to visit friends and family regularly. Mike wanted to stay on the road and explore new places. They never discussed their different expectations before starting van life.

The arguments started after two months. Sarah felt isolated. Mike felt restricted. They spent $800 on last-minute flights so Sarah could visit home for her sister’s wedding. Then another $1,200 for couples counseling to work through their problems.

They Don’t Discuss Money Expectations Upfront

One partner wants to save money. The other wants to have experiences. These different goals create conflict when money gets tight. Discuss your financial goals and limits before hitting the road. Agree on a budget and stick to it.

They Underestimate Relationship Maintenance Costs

Staying connected to family and friends costs money. Last-minute flights for emergencies or important events cost $800-1,500. Video calls use data. Shipping gifts costs more when you don’t have a permanent address.

They Ignore the Expense of Loneliness

Being alone on the road gets expensive. Lonely people eat out more, buy things they don’t need, and pay for entertainment to fill time. Budget for activities and social events. It’s cheaper than the alternatives.

The Reality of 24/7 Living

Van life tests relationships in ways normal life doesn’t. You’re together 24/7 in a small space while dealing with constant challenges. Some couples flourish. Others discover they’re not compatible.

The Relationship Investment Strategy

Have honest conversations about expectations before you leave. Agree on budgets for visiting family and maintaining friendships. Plan regular breaks from each other, even in a small space.

Relationship counseling might seem expensive, but it’s cheaper than breaking up and having to start over with separate vans and duplicate expenses.

Seasonal and Weather-Related Mistakes

Sarah and Mike’s van had no air conditioning and minimal insulation. Their first summer in Arizona was brutal. Daytime temperatures hit 115°F inside the van.

They had two choices: suffer through the heat or pay for hotel rooms. They chose hotels. $200 per night for two weeks cost them $2,800. They could have bought a good air conditioning system for less money.

They Don’t Budget for Seasonal Migration

Following good weather means driving long distances twice per year. Gas, wear and tear, and temporary camping add up. Budget $1,000-2,000 per year for seasonal moves between winter and summer locations.

They Have Inadequate Climate Control Systems

Cheap fans don’t cool you in 100°F weather. Poor insulation makes heating expensive in winter. Invest in proper ventilation, insulation, and climate control from the start. Hotel rooms cost $150-300 per night when your van becomes unlivable.

They Don’t Prepare for Weather Damage

Hail, wind, and flooding damage vans every year. Sarah and Mike’s neighbors lost solar panels in a windstorm. Another couple had water damage from poor roof sealing. Proper weather preparation costs a few hundred dollars. Repairs cost thousands.

They Stay in Expensive Destinations During Peak Season

Everyone wants to be in Florida during winter and in Colorado during summer. That drives up camping costs from $25 to $75 per night. Popular areas during peak times cost 2-3 times more than off-season or less popular locations.

The Weather-Smart Strategy

The weather doesn’t care about your budget. Plan for extreme temperatures, storms, and seasonal costs. It’s much cheaper than dealing with emergencies when they happen.

Consider less popular destinations during peak seasons. You’ll save money and avoid crowds while still enjoying good weather.

How Much Do These Van Life Mistakes Cost Them

Sarah and Mike planned to spend $35,000 in their first year on the road. They had it all budgeted out. Van payment, gas, food, camping, and a little extra for fun.

Their actual first-year costs were $52,000. That extra $17,000 came from the mistakes covered in this article. Here’s exactly where their money went:

Van Purchase: $12,000

- Immediate repairs they didn’t budget for

- Upgrades were needed to make the van roadworthy

- Additional tools and parts for maintenance

Conversion: $8,500

- Over-engineered electrical system

- Premium materials that didn’t add value

- Professional installation of simple tasks

- Rebuilding sections due to poor planning

Daily Living: $6,200

- Expensive campgrounds instead of free camping

- Restaurant meals instead of van cooking

- Tourist trap destinations during peak season

Technology: $3,100

- The Starlink system that barely worked

- Gadgets they never used

- Data overage fees from unlimited plans that weren’t unlimited

Emergency Costs: $11,700

- Transmission repair without emergency fund

- Hotel stays during extreme weather

- Medical bills from inadequate insurance

- Last-minute flights for family events

Legal and Insurance: $2,400

- Inadequate insurance coverage for conversion

- Domicile setup and ongoing fees

- Registration problems and fines

Total Extra Costs: $43,900

But the money wasn’t the worst part. These mistakes delayed their financial stability by eight months. Instead of reaching their target monthly budget in month four, it took them a full year.

The stress nearly ended their relationship and their van life dream.

The good news? They learned from every mistake. Their second year cost exactly what they budgeted: $24,000. They now help other people avoid the same expensive van life errors.

The biggest lesson is to start conservatively. Budget high and expect problems. It’s easier to spend less than you planned than to find money you don’t have.

Most importantly, don’t let perfect be the enemy of good. A simple van life setup that works is infinitely better than an expensive setup that bankrupts you.

Conclusion

Van life can be financially sustainable and incredibly rewarding. But only if you avoid these expensive mistakes that nearly bankrupted Sarah and Mike.

The key lessons from their $87,000 in van life mistakes:

Budget 30% more than you think you need. Buy based on function, not appearance. Start simple and upgrade later. Have an emergency fund before you need it. Get proper insurance and legal setup from day one.

Most importantly, learn from other people’s mistakes instead of making them yourself. Sarah and Mike’s expensive lessons can save you thousands of dollars and months of stress.

Ready to start your van life adventure without going broke? Download their free van life budget template that includes all the hidden costs they wish they’d known about. It’s already helped over 1,000 people start van life on a realistic budget.

Share this article with anyone considering van life. Help them avoid these costly van life budget mistakes before they drain their savings and dreams.